Surge in renewables despite policy uncertainties

The coming year promises to be interesting following Brexit and Trump – two outcomes we could not have anticipated just twelve months ago. Both factors have dramatically increased uncertainty around future policy directions, which will impact decision-making around financial investment in sectors where revenues are dependent on regulatory or policy regimes. This is particularly acute in the low-carbon energy sector. With Trump advocating for a stronger fossil-based economy, and Brexit resulting in the volatility of the Pound and increased risk for EU investment in UK energy infrastructure, these political events threaten a clean energy future.

Thankfully there are other trends at work such as the remarkable ongoing decrease of the capital cost of renewable energy generation and storage technology. A significant investment in renewable energy has already occurred in the UK, perhaps due in part to an unintentionally generous feed in tariff. And in the US, state and utility level decisions are seeing growing investment in solar and storage technologies as costs become increasingly competitive. There is also a growing realisation, particularly amongst large corporations, that investment in clean energy can be good for business.

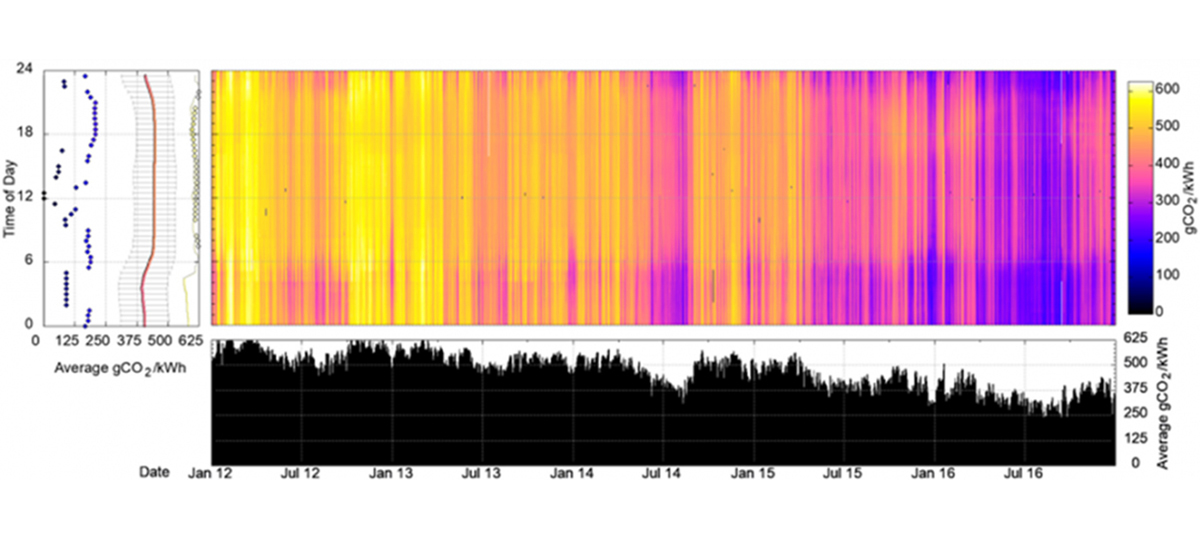

In the UK, the impact of investment to date has been the relentless decline in the CO2 intensity of the electricity we produce. The graph above shows the mean hourly average, the daily average and the 15-minute average over the last five years. This data is based on what the National Grid measures, so does not include about 40% of the wind generation and 100% of the solar PV production in the UK. Five years ago, very few people would have predicted that the UK could have made such a dramatic improvement over such a short time scale. And while significant further investment is required to deliver the right generation and storage mix in the next decade, clearly not all unanticipated outcomes are bad.

2017 may yet offer some good surprises yet!