May 2020: Change in energy patterns, Vehicle-to-Grid, low carbon heating, fake news, and opportunities to decarbonize the economy

Welcome to the May 2020 newsletter from the Oxford Martin School Programme on Integrating Renewable Energy! If you like what you read, please do subscribe directly!

The Joy of Energy

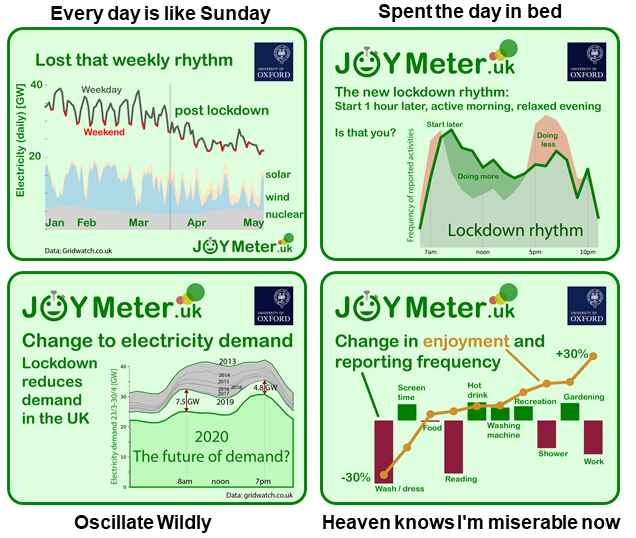

Philipp Grunewald and colleagues at the University of Oxford are studying how people use energy to understand societal activities and energy patterns. From this we can learn how changes in activity patterns result in higher or lower energy demand and which activity patterns are potentially flexible.

As forecasting demand for energy is just as important as forecasting renewable generation, to balance the supply of electricity versus demand for it, it is very important that we understand the link between activities, energy and variability. At the moment, due to lockdown, society’s normal activity patterns are massively disrupted and this has changed our energy use. Nationally, electricity demand has dropped to the lowest level for decades, due to the cessation of industrial and commercial use. But household energy has gone up as we stay at home.

Would you like to help use learn more? It’s easy and fun to do. First complete a short survey to get a link to the Joymeter app and anonymously report a few of your activities!

Here are some charts from the data collected so far: head over to the Joy meter website to read more about what they mean. And kudos to those who recognise the titles!

The new concept of Vehicle-to-Grid

Dr Katherine Collett of Oxford’s Energy Power Group, is working on the project “Vehicle to Grid Oxfordshire” or V2GO.

Vehicles are sat idle for most of the time. Electric vehicles have a battery within them that, when the car is not moving, is not doing much. The concept of Vehicle-to-Grid is to use the batteries in electric vehicles to store surplus renewable energy when it is produced. The electricity can then flow back to the national grid when there is a demand for electricity. In this way an EV is not just a vehicle, but an energy storage device!

The V2GO project is particularly focused on V2G for electric vehicle fleets, and real world V2G field trials are being undertaken. The focus is on vehicle fleets is because fleet managers can drive large-scale organisational change if a high value opportunity can be identified, thus making change happen quickly.

Why not watch Katherine’s short video, in which she explains the concept of Vehicle-to-Grid and what is being explored it the V2GO project?

The boundaries between traditional sectors are rapidly merging. The projected 2.5 million EVs in the UK by 2030 represents an enormous potential reserve of power and energy: a huge flexible power resource to be called on by the grid, equivalent to many power stations. It is interesting to see that Tesla have applied for a UK electricity supply licence…

Low carbon heating

We can reduce the carbon footprint of heating our homes with heat pumps… but they are not financially attractive. Why is this? And what can be done about it?

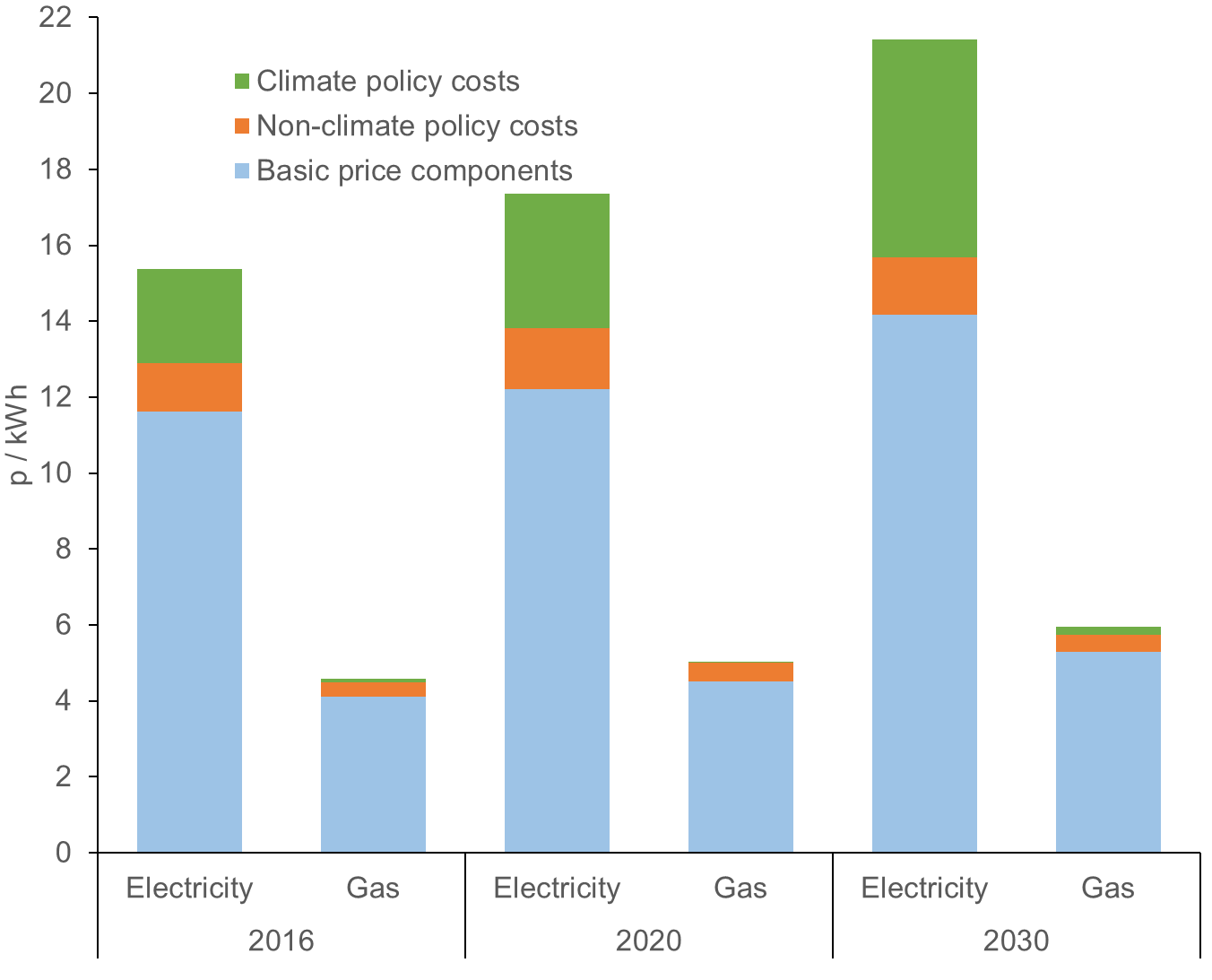

Jake Barnes & Sivapriya Mothilal Bhagavathy have investigated the unintended consequences of government energy policy. Could the taxes and levies placed on electricity in the UK be working against our need to lower carbon emissions from domestic heating?

These taxes and levies have received criticism for their adverse social and distributional impacts, and now there is concern that they may hinder the move to low carbon heating. This is because taxes and levies are applied more heavily on electricity bills than gas bills. This is bad news because while many people would want to decarbonise their heating, the low affordability of low carbon technologies is a major barrier facing many households.

The Committee on Climate Change agree and state that because the full carbon cost of fossil fuels is not included in their pricing, the existing UK tax and regulatory regime creates “perverse market incentives that work against low-carbon [electrified heating]” (CCC, 2016, p68).

These are the reasons why taxes and levies are higher on electricity than gas:

- Taxes: The EU Emissions Trading Scheme (EU ETS) and carbon floor price in the UK, impose a carbon price on electricity but not on gas. These taxes are passed through to consumers within the wholesale market price of electricity.

- Levies: Levies are placed on UK energy suppliers to pay for a range of environmental and social objectives, such as the winter fuel payment. The cost of these levies is passed through to households via domestic energy bills.

Residential gas and electricity price components 2016, 2020 and 2030 (p/kWh) (based on CCC, 2017).

Residential gas and electricity price components 2016, 2020 and 2030 (p/kWh) (based on CCC, 2017).

We need to reduce emissions from heating

Space and water heating account for approximately 80% of domestic energy use – we must reduce these emissions to meet our climate change goals. Indeed, the need to move off gas has been raised at the highest level, with then Chancellor of the Exchequer, Philip Hammond, proposing in 2019 that gas will be banned in new homes from 2025 in a bid to tackle emissions, and also deliver, “lower carbon, and lower fuel bills too”.

Generating heat from electric heat pumps is common in many European countries, and a promising decarbonisation pathway for the UK, where natural gas is the most common fuel used for space and water heating.

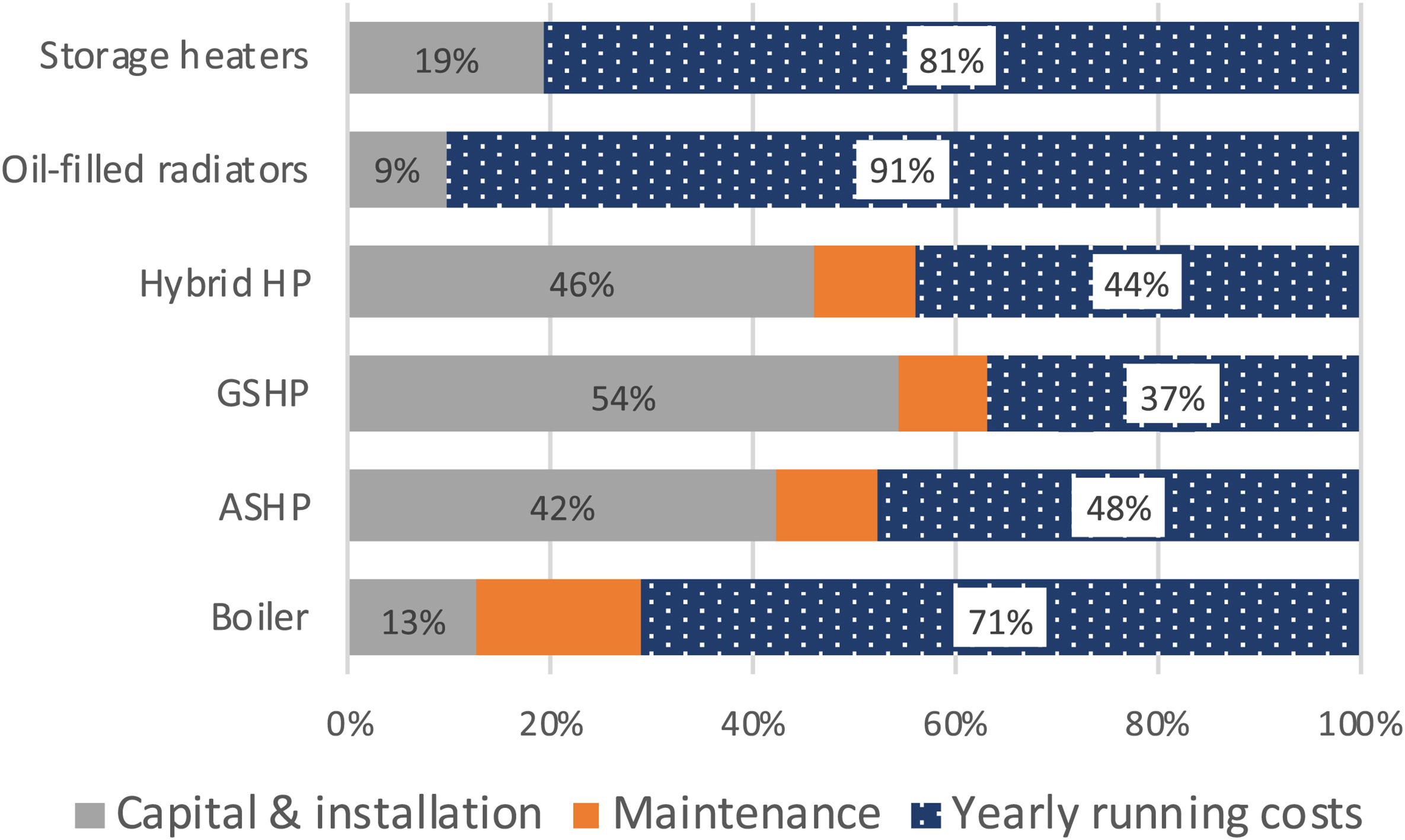

Jake and Priya’s research shows that efficient heat pumps would cost less to run than gas boilers, if it were not for the taxes and levies on electricity.

However, when also considering the upfront costs then the situation changes. The impact of taxes and levies is relatively small against the large upfront installation costs of heat pumps compared to gas boilers. These large upfront costs make heat pumps very unattractive to consumers from a cost perspective. This is especially so when occupants think they will not live in the property for a long time.

The cost of domestic heating systems: installation, maintenance, and yearly fuel expenditure. GSHP is ground source heat pump; ASHP is air source heat pump.

The cost of domestic heating systems: installation, maintenance, and yearly fuel expenditure. GSHP is ground source heat pump; ASHP is air source heat pump.

What can be done?

So while it is not true that the taxes and levies on electricity would result in higher monthly bills if an efficient heat pump is used, the larger upfront costs of the heat pump compared to gas boilers is a real cost barrier.

We recommend that government support is given to increase the roll out of heat pumps in order to reduce the upfront costs through economies of scale, competition, and lower labour costs (through greater experience). This could be done by increased public procurement, encouraging demand, standardised installation procedures, accreditation and training, and capital grants or loans to those wishing to install a heat pump.

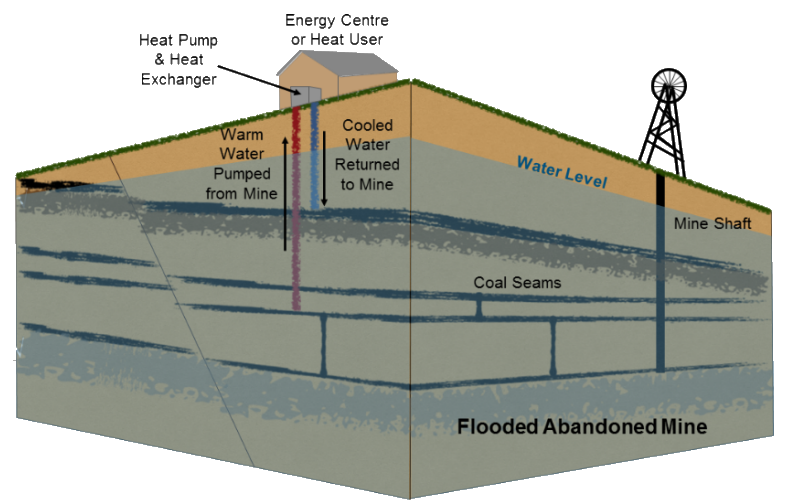

Geothermal energy

If heat pumps are not financially attractive, how about natural, renewable thermal energy that is unaffected by seasonal variations? Such as the geothermal heat from former mine workings. Did you know that 25% of buildings in the UK lie on a former coalfield? These former mine workings are a huge potential renewable thermal energy source, and could be a gamechanger.

Coal’s importance as a source of power in the UK has faded, with more than a month passing without any being used to power the national grid, and comments that globally, the coal industry will not recover after the coronovirus pandemic.The Coal Authority manages former mines on behalf of the Government (approximately 23,000 abandoned deep coal mines), and looking to develop their renewable energy potential.

Tapping into the geothermal heat resources of legacy mine workings, is a fantastic way to use heat (that would otherwise be wasted) to heat homes and businesses, reduce carbon emissions, and also regenerate and honour the cultural and community heritage of our industrial past.

During active mining, groundwater is pumped out to keep the workings dry. After the mine is abandoned and pumping stops, the groundwater rises back to the surface. Some closed mines still need pumping to ensure nearby and properties are not flooded. The ground water is warm as it is heated by geothermal energy from the earth’s core, and can reach temperatures of 10 to 20°C close to the surface, and over 40°C in deep shafts.

A fantastic example of a geothermal development is the Seaham Garden Village in County Durham that is being developed by Durham County Council, the Coal Authority, and Tolent Construction. This development could be the UK’s first large scale mine energy district heating scheme.

The development will be built next to the Dawdon mine water treatment scheme which has a continuous supply of water at 18 to 20°C. This could yield a constant 6MW of low cost, low carbon sustainable energy for local space heating use from the all year round. In this way, geothermal energy from nine workings could be much cheaper than other district heating schemes. Wider benefits include employment in the heat scheme and lower fuel bills to residents.

Money, Money, Money!

Beware Fake news: saving the planet does not cost the earth!

Below is a shortened version of John Rhys’ blog warning us to be wary of fake news…

There are longstanding debates about the economic costs of moving the world away from its addiction to the fossil fuels, and these will be renewed as the world emerges from the Covid-19 pandemic. However, the propaganda battle continues.

On 7th May the Financial Times commissioned an exchange of views between Christina Figueres, a former leader of the UN climate secretariat, and Benjamin Zycher of the American Enterprise Institute on the subject, “Can we tackle both climate change and Covid-19 recovery?”

Zycher claims that the IPCC advocates carbon taxes for 2030 with a midrange equivalent to $30 per gallon of petrol, an extreme position, and implying the hostility to humanity, of environmental campaigners.

Taxes at $30 for a gallon of petrol? Really? There are couple of things wrong here. First, that price is an order of magnitude error. Secondly, the IPCC does not take policy positions. If this price is incorrect this seems to be a particularly egregious example of dishonest reporting and misinformation.

Checking the citation, Chapter 2 of the IPCC Special Report: Global Warming of 1.5 ºC, reveals a technical summary of modelling methods and outputs, all heavily qualified as to assumptions, meaning and interpretation. On the carbon prices the text (around page 78) emphasises the “real world distinction … between implementable and notional [model] carbon prices …” and that any “price … estimated in modelling studies needs to be compared with what is feasible”.

Some policy proposals do indeed favour higher carbon prices (or taxes) of ~$100-200 per tonne. The same section of the IPPC report does identify evidence in support: “Literature has identified a range of factors … that support [social cost] SCC values above $100.” But this would amount to 90 cents per gallon (20 cents per litre), not Zycher’s hysteria-inducing 30 dollars.

If anything, environmentalists might be concerned that carbon taxes have so little impact on pump prices to consumers. It shows that taxing petrol is not an effective instrument for promoting low carbon transport –supporting the uptake of electric (or hydrogen) vehicles is more effective, such as ensuring charging stations are distributed around the country.

Click here to read John’s full article.

Now is the time to raise taxes on hydrocarbons

Daniel Hardy has written on the desirability and feasibility of raising carbon taxes following the collapse in oil and other energy prices caused by the Covid-19 crisis suggests that there is a political opportunity to introduce higher duties on hydrocarbons – a necessary component of any strategy to decarbonize the economy – while leaving retail prices unchanged, and generating revenue at a time of ballooning fiscal deficits. In these days the public may be more accepting of taxation of fuels that create air pollution, which is increasingly recognized as medically (and aesthetically) damaging, as well as climate change.

Daniel Hardy has written on the desirability and feasibility of raising carbon taxes following the collapse in oil and other energy prices caused by the Covid-19 crisis suggests that there is a political opportunity to introduce higher duties on hydrocarbons – a necessary component of any strategy to decarbonize the economy – while leaving retail prices unchanged, and generating revenue at a time of ballooning fiscal deficits. In these days the public may be more accepting of taxation of fuels that create air pollution, which is increasingly recognized as medically (and aesthetically) damaging, as well as climate change.

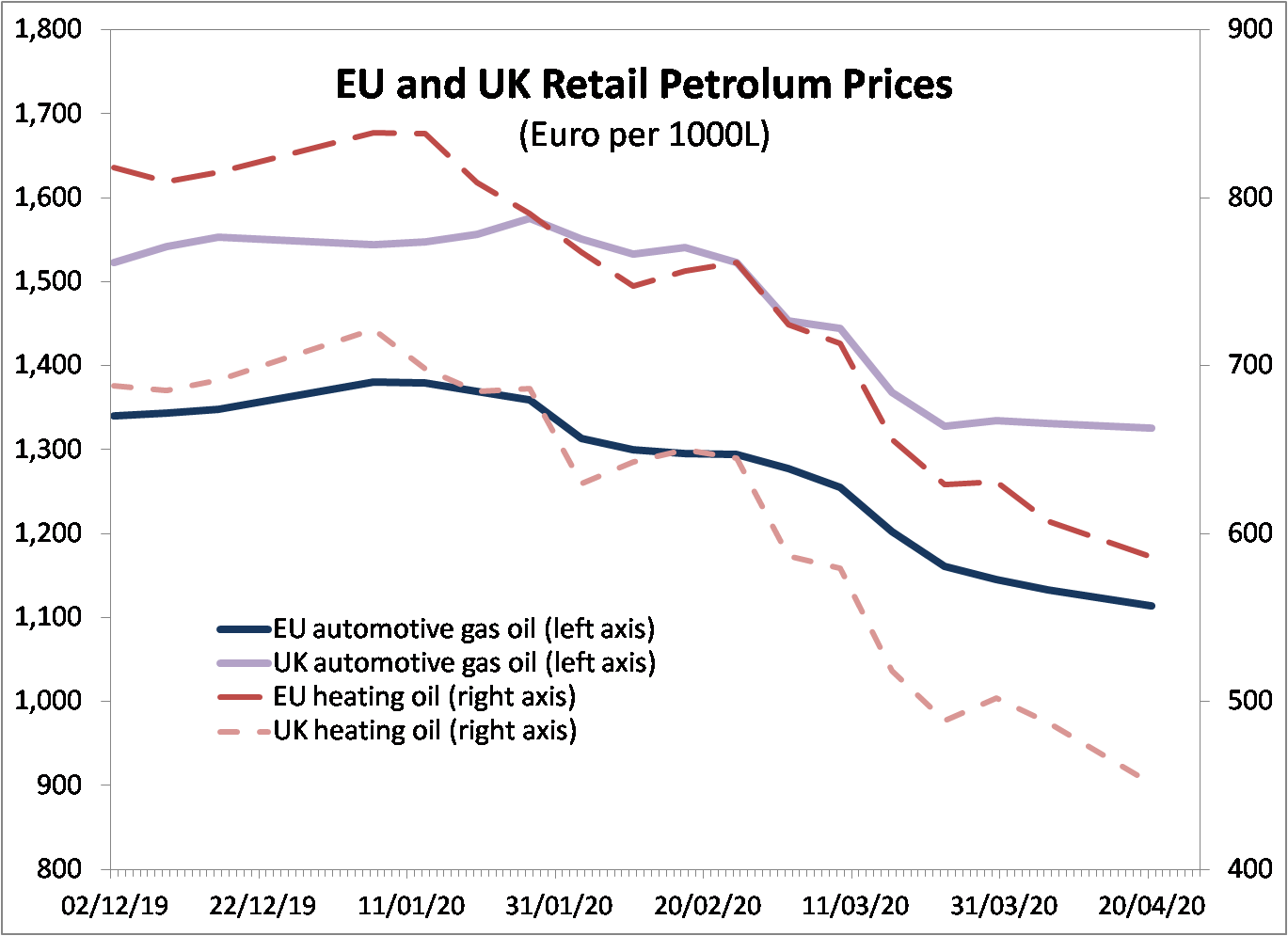

The collapse in hydrocarbon prices provoked by the Covid-19 crisis has opened up an opportunity for Europe to advance the de-carbonization of the economy. Because the price of oil and other fossil fuels have fallen so much, it makes economic and political sense to increase duties on hydrocarbons. In this way, the climate externality costs can be added to fossil fuels, an essential step in reducing carbon emissions and limiting climate change.

Restoring hydrocarbon prices by adding taxes at least to pre-crisis levels would also help remove the disparity between subsidized fossil fuel production, and unsubsidised renewable energy generation. This would help balance the costs of renewable energy and conservation measures, ensuring they remain financially attractive to investors so that further rollout continues.

Restoring hydrocarbon prices by adding taxes at least to pre-crisis levels would also help remove the disparity between subsidized fossil fuel production, and unsubsidised renewable energy generation. This would help balance the costs of renewable energy and conservation measures, ensuring they remain financially attractive to investors so that further rollout continues.

The COVID-19 pandemic has distracted attention from, but actually reinforces the urgency of the European Green Deal. Indeed, many including the World Economic Forum, argue that the European Green Deal must be at the heart of recovery meaures.

You can read Daniel’s full blog here.

A green COVID-19 recovery: THE opportunity to Build Back Better

Many people are calling for Covid-19 recovery measures, initiatives and economic recovery packages, to factor in decarbonisation programme and policies. The economic help and stimulus on offer must be used to help make the change to help us meet our climate goals, and help people who have lost their jobs due the pandemic to retrain in green industries and create the workforce of the future.

Many people, from financiers to land managers and national planning agencies to climate advisors, have stated their desire for the lockdown to make the point of transition and not to go back to the old normal, before the coronovirus lockdown. A “dirty” recovery, as seen so far in China, can cause pollution levels and emissions to soar higher than before.

While some may argue that green measures are expensive, these views are now out of date. Research by a team of internationally-recognised experts, including Cameron Hepburn at the University of Oxford, Joseph Stiglitz and Nicholas Stern, shows that that climate-friendly policies can deliver a better result for the economy – and the environment.

Their analysis of possible COVID-19 economic recovery packages shows the potential for strong alignment between the economy and the environment. Their examination of stimulus policies, global survey of hundreds of experts, and learnings from the 2008 financial crisis, has revealed that green projects create more jobs, deliver higher, short-term returns per dollar spend, and lead to increased long-term cost savings, by comparison with traditional fiscal stimulus.

The green policies include:

- Zero carbon energy generation, storage, and distribution

- Reducing industrial emissions

- Building climate-smart infrastructure

- Broadband connectivity investment

- Investment in broadband infrastructure

- Nature-based solutions investment

- Electric vehicle conversion

- Home renovations and retrofits

- Education and training

- Conditional bailouts

For developing countries, rural support scheme spending, such as on sustainable agriculture, is also very important. Non-conditional bailouts such as those to airlines give very little benefit back to society in both economic and climate metrics.

While the coronovirus emissions reduction could be short-lived, decisions made now, and in the next six months will play a large role to determining whether the worst impacts of global warming can be avoided.

If not now, when?

Most G20 governments have implemented significant relief measures, as a result of the pandemic. But, as yet, none has introduced any significant fiscal recovery measures. Now is that generational opportunity to put decarbonisation fully into national plans – for the economy – and for the environment benefits too.

Words, words, words

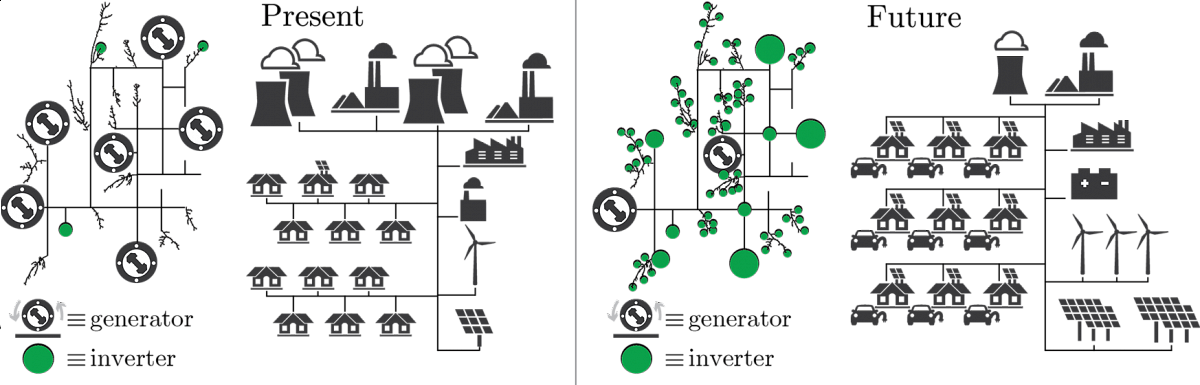

In this regular feature, we will be shining a light on words used in energy circles. Last month, we featured peer to peer energy trading. This month: reactive power!

The electricity used for work, such as making a laptop operate or lighting a lamp, uses what is called active or real power. In AC electrical systems, such as in the UK, getting this active power to travel to the place where it is needed uses ‘reactive power’. As the amount of electricity flowing along a line increases, so does the amount of reactive power needed to move the electricity and maintain the correct voltage.

Power plant generators produce active power and reactive power. Imagine a horse pulling a barge along a canal. The horse is on the towpath, so on the side of the barge. Some of the force on the towrope is ‘useful’ (active) as it pulls the barge forwards along the canal. However, some of the force generated does not actively move the barge forward; instead it moves the barge sideways towards the canal bank (reactive).

Problems are caused by too much reactive power in the system (over-voltage, needing power factor correction equipment to absorb it) and from too little (blackouts from voltage drops).

When equipped with smart inverters, renewable energy systems, such as wind or photovoltaic (PV) arrays can regulate reactive power and the voltage of power grids. Connecting PV power to the electrical grid however introduces unique challenges such as variability, where the power outputs can change quickly. The resulting voltage variation stresses non-smart or legacy power management equipment.

Step forward smart inverters! These work just like traditional inverters, but are also able to absorb and output reactive power. Using solar panels with smart inverters in this way was done in the UK for the first time on 4 November 2019, meaning solar farms can keep the lights on, even at night! This is a huge step forward for increasing the world’s use of renewables!

Thanks for reading!